With e-commerce and online transactions, cart abandonment or payment drop-off rates can be up to 70%. This makes it crucial for businesses to address and reduce friction to improve their customer checkout experience and increase revenue.

Xendit’s Direct Debit product is the game-changer for our merchants. With our direct debit, merchants can provide seamless payment flows for their customers, reducing drop-off rates from customers. Xendit provides direct debit channels with two of the biggest banks in the Philippines, UnionBank and BPI.

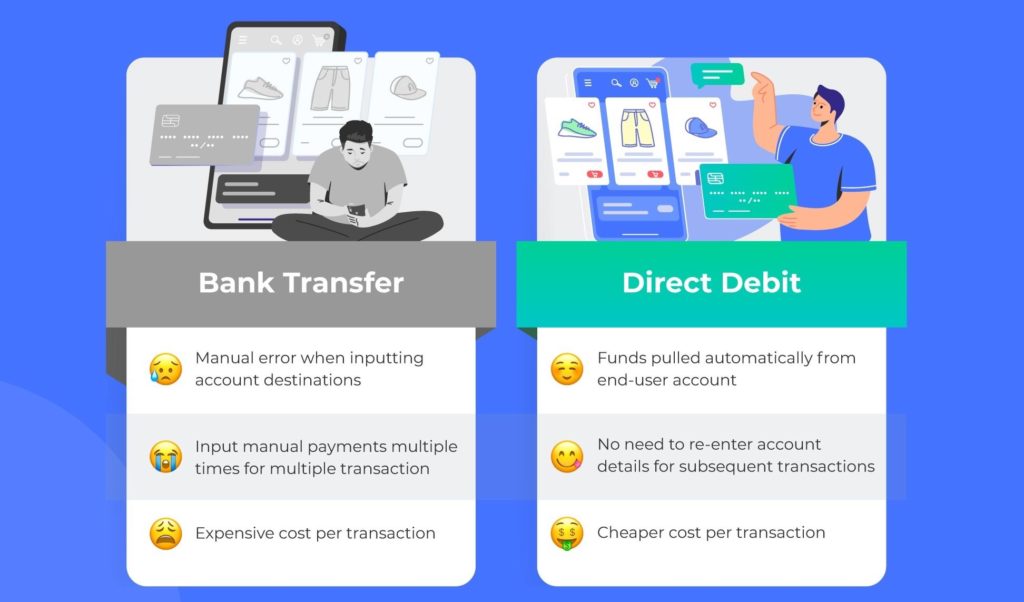

Direct Debit vs Bank Transfers

While funds are pulled from the same account, direct debit is not a regular bank transfer. With bank transfers, end-customers would have to manually input the destination account as well as the amount that they want to transfer. This could result in human error, be it transferring to the wrong account or the wrong amount.

On the other hand, direct debit pulls funds directly from end-customers online bank accounts. Unlike bank transfer where customers would have to input the destination and amount manually, direct debit allows the amount to be entered and payment triggered by the merchant. This tokenized payment flow enables one click check-out for high ticket items, helping relieve inconvenience in the checkout process.

Direct Debit can help solve the following key reasons why users drop-off.

- Unnecessary check-out steps – the more steps there are in a payment flow, the more opportunities for end customers to hesitate in completing the transaction. Direct debit runs on tokenized payments, enabling merchants to enjoy one click payment flow. This significantly reduces payment friction.

- Insufficient balance or credit – end customers do not always keep track of balance in their accounts, there is a higher probability of payment failing if the end customer uses eWallets or Credit Cards. Direct debit is linked to the end customer’s bank account, resulting in a higher likelihood of a successful payment

- Per transaction authentication issues – payment drop offs happen when end customers are not able to receive SMS, forgotten PIN or mobile app issues. With a tokenized payment flow in direct debit, end customers just have to authenticate once and avoid any authentication issues for subsequent transactions.

- Compulsory OTP requirement – OTP on every transaction blocks merchants from supporting subscription models or payment plans. Xendit helps to solve this by offering direct debit without OTP and a recurring payment APIs for our merchants

Direct Debit is ideal for

- Ecommerce business – Increase payments acceptance rates for high value items with direct debit and receive payments with fast settlement times

- Subscription services – Auto debit (recurring) from your user’s bank account without the need for authentication each time. Some examples include collection of membership fees, SaaS services, Over-the-top (OTT) media services

- Mobile Wallet top ups – Move funds from the user’s bank account to your e-wallet easily and quickly without performing multiple tedious steps

- Financial services – Secure payment infrastructure that enables financial companies to receive high-value payments on a recurring basis – insurance (annual/ monthly), investment plans

How does Xendit’s Direct Debit work?

When merchants enable direct debit payments via Xendit, end-customers can select direct debit payments on the merchant’s checkout page. End customers can then register their debit cards or online bank login. After a one-time authorization, merchants can pull funds directly from an end user’s bank account without OTP for subsequent payments.

On top of that, merchants can enjoy instant settlement and fees significantly lower than traditional credit card fees. One of Xendit’s merchants who have enabled Direct Debit channels on their platform is AQWIRE, a Global Property Marketplace that fully utilizes Smart Contract technology to process cross-border real-estate transactions. Xendit’s Direct Debit helped them to reduce costs by more than 95%.

“Before Xendit, we could only accept card and e-Wallet payments. Xendit’s online banking option helped us reduce our fees by more than 95%.” – Inno Maog, Chief Marketing Officer @ Aqwirew

Getting Started

Getting started is really easy. New customers would just need to sign up with the Xendit dashboard, and they can start testing our APIs immediately. Integration with Xendit’s Direct Debit can be performed with API/TPI integration (i.e. Shopify, Wix, WooCommerce, etc) or generating invoices on our hosted payment page, xeninvoice.

Activation of direct debit with the bank can even be as short as 1 day. With a one time integration, merchants will be able to enjoy direct debit bank channels across the region and subsequent newer direct debit payment channels added to Xendit in the coming months.

Get started fast with no set up or monthly fees. Find out more about Xendit, or sign up to try our dashboard today!